An article by Iain Campbell and Ben Brierley of FC Corporate Finance

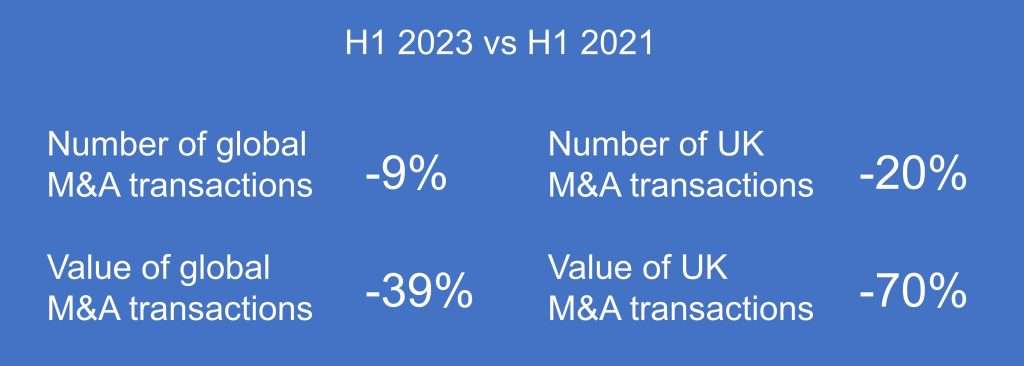

In a recent article we highlighted the downturn in both the global and the UK mergers and acquisitions market and how the number of global M&A transactions in in the first half of 2023 was down 9% compared to the first half of 2021 and the total value of deals compared for the same two periods was down 39%. Here in the UK downturn since then has been sharper than the global trend – deal volumes 20% down in the first half of 2023 compared to the first half of 2021 and the total value of deals compared for the same two periods down a whopping 70%.

What’s behind these trends? Geo-political factors affecting the global economy since early 2022 will certainly have had an adverse effect on buyers’ confidence. In the UK this is likely to be heightened by ongoing post-Brexit economic challenges and by political instability. However, we believe the single biggest factor (and it’s linked to these issues) is the current interest rate environment. Interest rates in the UK were reduced to very low levels when the financial crisis started in 2008 and they remained very low (mostly less than 1.0%) all the way through until 2002. Now they’re at 5.25% and we may not yet have seen the peak.

Through much of the period of low interest rates and especially in the years immediately preceding 2022 we saw record mergers and acquisitions activity driven to a large extent by private equity buyers, for whom using significant leverage is normally an essential part of making deal pricing work (usually at a premium to trade buyer pricing), and also some corporate acquirors doing deals funded by wholly or mostly by debt. In those heady days the constraining factor on acquisition finance was typically a multiple of the EBITDA of the combined buyer/target. Sure, there were other ratio tests, but this was the one that topped out first. Now, because of much higher interest rates, we are seeing debt service ratios top out at considerably lower debt levels than the EBITDA ratios do, reducing the amount of leverage that can be got into deals and reducing the buyer’s ability to pay a premium price.

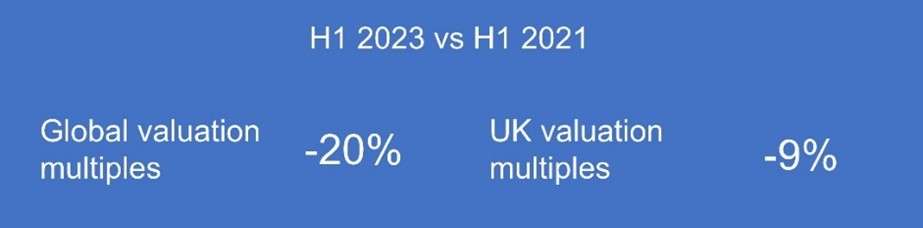

Largely as a result of this we believe, reported EBITDA multiples for Q2 2023 were about 20% lower than the peak in 2021 and about 9% lower in the UK across the same period.

Whilst bad for sellers, private equity and leveraged buyers, these new market conditions, while they last, offer significant opportunity to corporate acquirors who have the cash reserves to make acquisitions without resort to borrowing. Smart trade buyers who are fortunate enough to have cash at this time may see the relatively favourable pricing environment as a good time to be making more acquisitions. Indeed, research published in the Harvard Business Review in 2020 concluded that acquisitive corporates with strong liquidity positions who carried on making acquisitions through the financial crisis in 2007/8 generated total shareholder returns in the five years that followed of more than three times that of other companies. If you are a cash buyer there’s better pricing and target availability now than at any time in recent years, so maybe it’s the right time to be acquiring.

FC Corporate Finance is a UK-based advisory firm. The areas we specialise in include, amongst other things, private company mergers and acquisitions (both in the UK and internationally) in the mid-market and SME space. We have very extensive experience in both “buy-side” and “sell-side” and are intensive and hands-on advisers and process managers through the whole cycle – acquisition strategy, origination, target evaluation, target valuation, deal structuring and negotiation, implementation, due diligence (if required), and detailed contract negotiation through to completion.

In recent years we have been particularly active on buy side, including in the IT distribution and IT reseller space, staffing agency, cleaning, security and other personnel-orientated businesses. We also have internationally-recognised capability and experience in deals in the passenger ground transport industry.

E-mail: ic@fccorporatefinance.com

E-mail: bb@fccorporatefinance.com

FC Corporate Finance Limited is not authorised under the Financial Services and Markets Act 2000 but we are able in certain circumstances to offer a limited range of investment services to clients because we are members of the Institute of Chartered Accountants of Scotland. We can provide these investment services if they are an incidental part of the professional services we have been engaged to provide. FC Corporate Finance Limited has a policy of professional indemnity insurance with Arch Insurance Company (Europe) Limited of 60 Great Tower Street, London EC3R 5AZ. This policy has worldwide application except in relation to professional business carried on by the insured from its own offices in the USA or Canada.